價格:免費

更新日期:2020-06-24

檔案大小:126.8 MB

目前版本:2.10.22

版本需求:系統需求:iOS 10.0 或以後版本。相容裝置:iPhone、iPad、iPod touch。

支援語言:英語

Manage your money easily and invest in your life goals with the free 22seven app from Old Mutual.

Here’s how it works:

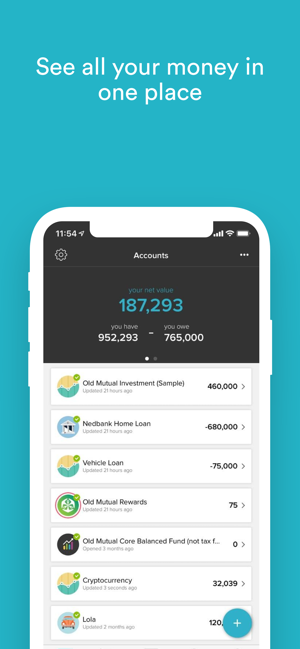

#1 - See all your money in one place.

All your accounts. All your transactions. All together. Link bank accounts, credit and store cards, investments, loans and rewards from over 100 South African financial institutions.

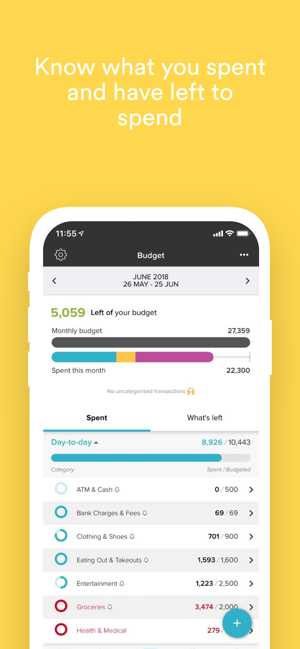

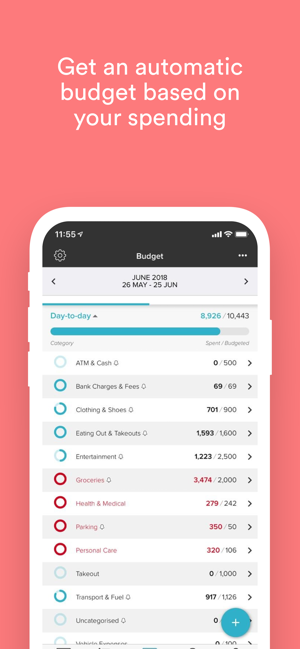

#2 - Set budgets and we’ll help you stick to them.

See exactly how much you spend on what each month. Know what you‘ve already spent and have left to spend, and find more money. Activate spending alerts and we’ll let you know when you’re getting close to reaching your budget.

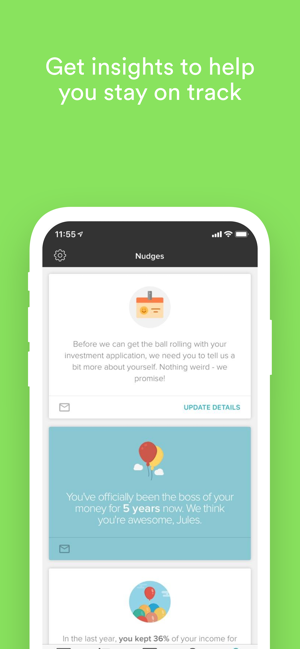

#3 - Find relevant insights, regularly.

Nudges are hints and observations about your money. See things you didn’t know or hadn’t considered, and use your money better.

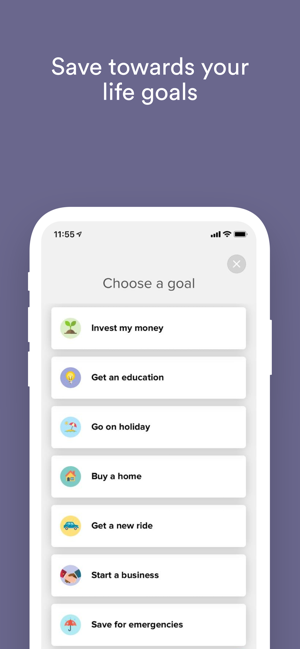

#4 - Invest in your life goals and reach them sooner.

Putting money towards your future can be a pain. But the right planning can change that. Set, track and invest in your life goals, tax free, from as little as R250.

#5 - We take security very seriously.

Most importantly, 22seven is safe, secure, private and insured. We use the best security - the same measures as banks, governments and the military. The information you share is always encrypted and never seen by human eyes. Your info remains yours - always. So we won’t sell your data to third parties. That’s why over 220 000 South Africans use 22seven to boss their money.

Want to know more? Keep reading:

22seven (sometimes referred to as 227) is South Africa’s best budgeting app. We support over 100 South African financial institutions. This includes all major banks like ABSA, Capitec, FNB, Nedbank, Standard Bank, TymeBank and more. The app is backed by Old Mutual - one of South Africa’s most trusted financial institutions.

The app lets you:

#1 - View all your balances and transactions in one place so you can track them easily.

Once you link your accounts from over 100 South African companies, you’ll get to see all your money in one place for the first time. The app automatically sorts all your transactions into categories for you, like Groceries, Eating Out & Takeouts, Rent and more. So you can track exactly where you’re spending and find new ways to save.

#2 - Create a budget to effectively manage your spending.

The app will create a budget for you based on your real, average spend. But if you want to challenge yourself to spend less, setting your own budget is easy. And when you’re done, activate spending alerts so we can let you know when you reach 50%, 80% and 100% of your budget so you don’t overspend.

#3 - See how much you can safely spend each day.

Every day, 22seven will let you know how much you can safely spend while still sticking to your monthly budget. As you use the app, you’ll start to receive other ‘Nudges’ - little bits of information about how you’re spending and how your behaviour compares to other 22seven customers.

#4 - Invest in your life goals so you can reach them sooner.

Saving money in your bank account or a fixed deposit account may be familiar. But investing can be so much better. Create your life goals in 22seven and invest in them so you can reach them sooner. You’re able to choose from 4 Old Mutual unit trust investment funds, where you can safely store your money and track how it grows.

Here are some other features:

#1 - No more separate statements or slips.

Your income and expense transactions are gathered and updated whenever you log in. You can also add notes, visualise or export your spending data at any time.

#2 - Doing your tax return is made so much easier.

All your income and expenses are categorised and exportable to Excel. So you can also use your transactions in 22seven to rock your tax return. And get a 25% discount with TaxTim.

#3 - Get really good support from real, live people.

Our support team, the Svens, are on hand to answer your questions from 8am to 8pm every day of the week. Via email, live chat or phone.